Ignoring the risks of the EV stock bubble deflating further, Lucid’s flagship Lucid Air model is a compelling product. Lucid and the EV industry need prices of batteries to drop dramatically. Prices for metal and computer chips are a small portion of costs. Shareholders need to expect input costs to fall. In the long term, its business model has a better chance of surviving investor scrutiny. The company has no hope of reporting a profit in the next few years. Short-term investors will realize that cost growth will greatly exceed revenue. In addition, it has to build a retail network and service center, both domestically and internationally. It needs to support manufacturing facilities and its associated machinery tooling and equipment. The company forecasts a capital expenditure of around $2 billion in 2022. Assuming that rate continues, the company could run out of cash in a few years. In Q4, Lucid spent $163.6 million on research and development and $750.2 million for the year. Its balance sheet has $6.26 billion in cash, up from $614,412 in 2020.

Speculative growth investors may forgive Lucid for its weak quarterly performance.

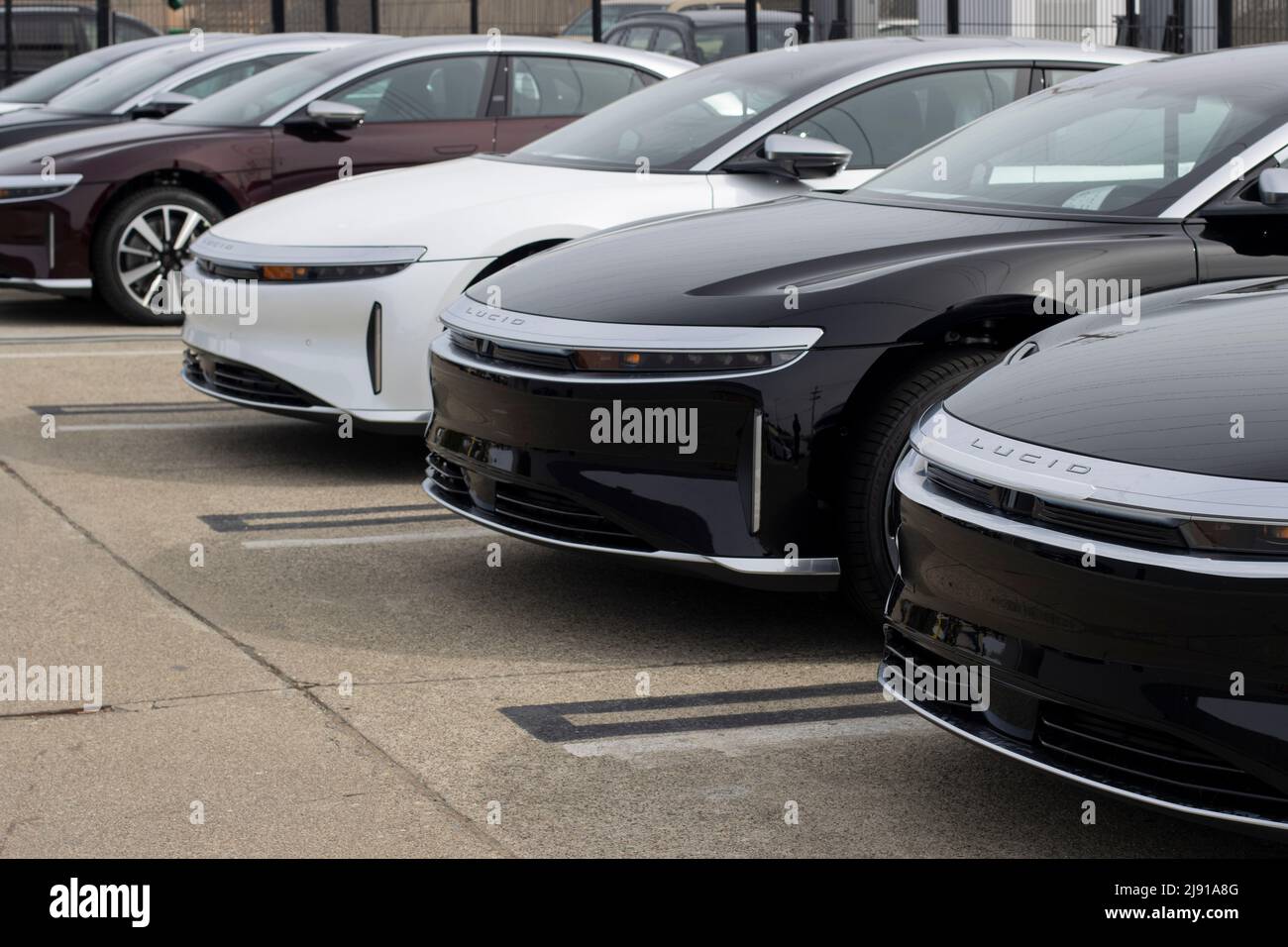

LUCID AIR STOCK FULL

That leaves it with only two full years of reservations left. Investors may assume that Lucid meets its 12,000 annual production rate forecast. Lucid said customer reservations are now over 25,000. This is far below the 12,000 to 14,000 production outlook for Lucid Air.

What is disconcerting is the annualized rate is 125x four quarters, or 500 units a year. Still, at 300 deliveries to date, total revenue is no more than around $80,000 per unit or $24 million. Lucid production exceeded 400 vehicles and delivered 125 units as of the end of 2021. However, the revenue of $26.39 million is practically a rounding error compared to its market capitalization in the tens of billions. Revenue rose by a seemingly impressive 627% year-over-year. 28, Lucid posted fourth-quarter GAAP earnings per share loss of 64 cents. Therefore, Lucid stock will continue meandering before the penny drops, and as a result, the shares might experience previous lows.On Feb. NASDAQ InvestorPlace segment also noted that it is worth considering there are not many near-term catalysts left for investors to exploit. While both these announcements got a pompous reception, NASDAQ warns that investors need to be aware of the company's high volatility before investing any money into it. "As much as I love the story, I hate the timing." He said.Īfter a successful launch of the Lucid Air, the California-based EV start-up will also bring an SUV called Gravity into its lineup in 2023. " Mad Money" host feels the timing is incorrect, especially with another lockup expiration coming later in the month. Peter Rawlinson, Lucid Motors CEO, told CNBC that the EV start-up has plans to build factories in the Middle East and China. The California-based electric vehicle company started commercial production in September and announced the kick-off of its Lucid Air electric sedan deliveries in late October.

However, he cautioned investors that Lucid Motors is still in the early stages of scaling up production. However, the stock rose again due to specific short-term catalysts.Ĭramer quickly pointed out that many investors are out for the next Tesla, and Lucid seems like a viable option. The EV automaker's stocks skyrocketed after a merger earlier in the year with s pecial purpose acquisition company (SPAC) Churchill Capital Corp IV but later gave up most of its gains. According to NASDAQ, Lucid Motors' stock has risen more than 68% in the last three months.

0 kommentar(er)

0 kommentar(er)